Everything you read here is advice only, and I am not a licensed financial advisor, this is simply my opinion based on my experience. All information provided here can be potentially wrong or misinterpreted and it is highly recommended you do your own research.

If you find this post helpful at all, please leave an upvote and share it among your friends so that they may benefit from this as well.

As BMT has recently started for most and with new enlistee joining in the frill. I thought I’d be a great idea to provide all the new recruits some financial advice based on what I’ve learned and observed through the mistakes I and others have made during their service.

For some of you, this is the first time where you’ve received a steady stream of income, without having to rely on your parents/guardians to bankroll your expenditures. But what I’ve seen too often is individuals blowing through their monthly allowance, without saving some of their income for future goals, such as a potential ORD trip.

Savings

As a “Chao Recruit”, you’ll be earning a measly sum of $580 initially during your BMT. Many of us still hold a basic POSB Passbook Account which we had since we were a child. But this account only pays a measly sum of 0.05% interest per annum. With interest like this you’d be better off stuffing your cash under your bed, and in actuality, with rates as low as this, you are actually LOSING money due to INFLATION! So I highly recommend you go looking around online to try and find the best account

Here are some accounts I have found online that may interest you.

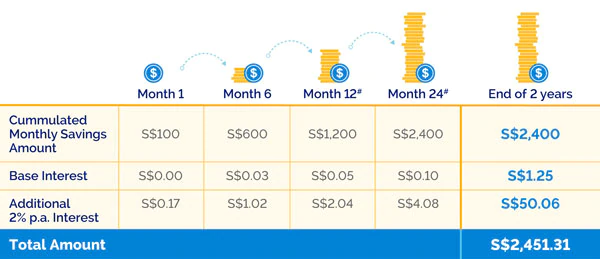

POSB SAYE (Save As You Earn) Account

Base interest for monthly deposits

| $50 - $290 | 0.05% p.a |

|---|---|

| $300 - $790 | 0.20% p.a |

| $800 - $1490 | 0.25% p.a |

Note: Bonus interest of 2% given for the first 2 years.

Bonus 2% credited on the 13th month and 25th month

If withdrawal is performed, all past months accumulated 2% Bonus interest will be forfeited.

So if you choose this account, ensure that you won’t touch the funds within the account for 2 years.

Standard Charted JumpStart Account

Based interest 2% p.a on deposits up to $20,000

Any amount exceeding $20,000 subjected to interest rate of 0.10% p.a

Monthly deposit: $100

Initial Deposit: $0

Rate: 2%

Period: 2 Years

Compound: Monthly

Savings: $2,446.57 = Interest Gain: $46.57

On top of that you’d also get a 1% cashback debit card on eligible card spends

Note: Ages 18 - 26

No Penalties for withdrawal from account.

CIMB FastSaver Account

Base Interest: 1% p.a for the first $50,000

Monthly deposit: $100

Initial Deposit: $0

Rate: 1%

Period: 2 Years

Compound: Monthly

Savings: $2,423.14 = Interest Gain: $23.14

These are the list of my personal recommendations for savings accounts for NSF that I’ve used or thought of using.

Investment:

It is a good idea to save 50% of your income and further split that into 20 - 30.

20% of the 50% you have allotted for savings should go to a traditional HISA ( High Interest Savings Account) while the leftover 30% should be invested into the stock market.

There are a multitude of avenues you could utilise to invest your money into in order to grow your wealth for your future goals whether it be an overseas trip or down payment for an HDB in the future.

You can typically find investment instruments from your local banks

DBS: dbs.com.sg/personal/investments/default.page

OCBC: ocbc.com/personal-banking/investments

UOB: uob.com.sg/personal/invest/index.page

You can even utilise robo advisors here in Singapore to help automatically invest your money for you through a diversified portfolio of ETF ( Exchange Traded Fund) securities.

StashAway: stashaway.sg

Syfe: syfe.com

I’m pretty new to this myself so I don’t have much knowledge on the topic but one of the key piece of advice I’ve learned from countless personal finance videos and books is to start while you are young for the your wealth to grow exponentially at a faster rate then if you were to start later, as time is your only enemy.

Use your admin time or simply whenever you are free to look and read them up so that you can invest in your future.

References

blog.seedly.sg/national-service-ns-how-much-can-one-save

blog.moneysmart.sg/invest/investment-brokerage-singapore-guide